MBA in Fintech Innovation represents a dynamic intersection of business acumen and technological disruption. This program isn’t just about learning finance; it’s about shaping the future of money. We’ll explore the cutting-edge advancements driving the fintech revolution, from blockchain’s impact on financial services to the transformative power of AI in risk management and beyond. We’ll also delve into the ethical considerations and strategic approaches needed to navigate this rapidly evolving landscape.

This exploration will cover the core curriculum, comparing it to a traditional MBA, and highlighting specialized career paths. We’ll examine the funding models crucial for fintech startups, analyze successful case studies, and ultimately, project the future trends influencing this exciting field and the skills you’ll need to thrive in it.

Program Overview: MBA In Fintech Innovation

An MBA in Fintech Innovation offers a specialized curriculum designed to equip graduates with the business acumen and technological understanding necessary to thrive in the rapidly evolving financial technology sector. It blends traditional MBA core concepts with a deep dive into the intricacies of fintech, preparing students for leadership roles across various areas of the industry.This specialized MBA program differs significantly from a traditional MBA in its focus and career trajectory.

While a traditional MBA provides a broad business foundation applicable across many industries, an MBA in Fintech Innovation provides a niche expertise highly sought after by companies operating in the fintech space.

Curriculum Structure

A typical MBA in Fintech Innovation curriculum incorporates core MBA subjects such as finance, accounting, marketing, and strategy, but significantly enhances these with specialized fintech courses. Core courses often include topics like blockchain technology, digital currencies, regulatory technology (RegTech), financial modeling for fintech applications, and the economics of the digital financial ecosystem. Elective options may delve into areas such as artificial intelligence in finance, cybersecurity for financial institutions, mobile payment systems, crowdfunding platforms, and the ethical considerations of financial innovation.

The curriculum often includes practical elements like case studies, simulations, and potentially even a capstone project focused on a real-world fintech challenge.

Career Paths

Graduates of an MBA in Fintech Innovation program typically pursue careers directly within the fintech industry, holding positions such as product managers, business analysts, financial technology consultants, investment bankers specializing in fintech, risk managers for fintech companies, or entrepreneurs launching their own fintech ventures. In contrast, graduates of a traditional MBA program have a wider range of career options across diverse industries, including consulting, general management, and various functional roles within established corporations.

While some traditional MBA graduates may find themselves in the fintech sector, their path to such roles may require more lateral movement or further specialized training. The MBA in Fintech Innovation provides a more direct and focused pathway.

Admission Requirements

Admission requirements for an MBA in Fintech Innovation program are generally similar to those of a traditional MBA program, but may place greater emphasis on quantitative skills and prior experience in technology or finance. Typical requirements include a bachelor’s degree from an accredited institution, a strong GMAT or GRE score, professional work experience (often 2-5 years), and a compelling application demonstrating interest and aptitude in the fintech sector.

Some programs may also require specific coursework or certifications in areas such as programming or data analysis to demonstrate a foundational understanding of technology. The application process usually involves submitting transcripts, letters of recommendation, and a personal statement outlining career goals and motivations for pursuing the program. Interviews are also a common part of the selection process.

Fintech Innovation Specializations

This section delves into three rapidly evolving specializations within the dynamic field of Fintech innovation, highlighting the crucial skills and knowledge required for success in each area, and providing insights into associated job prospects and salary expectations. Understanding these specializations is key to navigating the future of finance and technology.

Open Banking and APIs

Open banking leverages APIs to allow third-party providers access to customer financial data, fostering innovation and competition. This specialization requires a strong understanding of API architecture (REST, GraphQL), data security protocols (OAuth 2.0, OpenID Connect), and regulatory compliance (PSD2, GDPR). Furthermore, a solid grasp of software development principles, database management, and data analytics is essential. Individuals in this field need to be comfortable working with large datasets, ensuring data privacy, and developing secure and scalable applications.

Decentralized Finance (DeFi)

DeFi represents a paradigm shift in financial services, utilizing blockchain technology to create transparent, permissionless financial applications. Specialists in this area need a deep understanding of blockchain fundamentals, smart contract development (Solidity, Vyper), cryptography, and decentralized applications (dApps). Knowledge of financial instruments, risk management, and regulatory frameworks specific to cryptocurrencies and DeFi is also crucial. Experience with decentralized storage solutions (IPFS) and understanding of consensus mechanisms (Proof-of-Work, Proof-of-Stake) are also highly beneficial.

Artificial Intelligence (AI) in Fintech

AI is rapidly transforming financial services, enabling more efficient processes and personalized customer experiences. This specialization requires expertise in machine learning algorithms (regression, classification, clustering), deep learning techniques (neural networks, convolutional neural networks), and natural language processing (NLP). A strong understanding of data science principles, statistical modeling, and data visualization is essential. Professionals in this field should also possess a solid understanding of financial markets and regulations, allowing them to apply AI effectively and ethically within the financial sector.

| Specialization | Job Prospects | Salary Expectations (USD) | Required Skills (Summary) |

|---|---|---|---|

| Open Banking and APIs | High; growing demand for developers and architects experienced in secure API integration and data management. | $80,000 – $150,000+ (depending on experience and location) | API design, data security, regulatory compliance, software development |

| Decentralized Finance (DeFi) | High growth potential; demand is increasing rapidly for blockchain developers and DeFi specialists. | $100,000 – $200,000+ (highly variable based on experience and project involvement) | Blockchain technology, smart contract development, cryptography, decentralized applications |

| AI in Fintech | High demand for data scientists and AI engineers with expertise in financial applications. | $120,000 – $250,000+ (depending on experience and specialization within AI) | Machine learning, deep learning, NLP, data science, financial modeling |

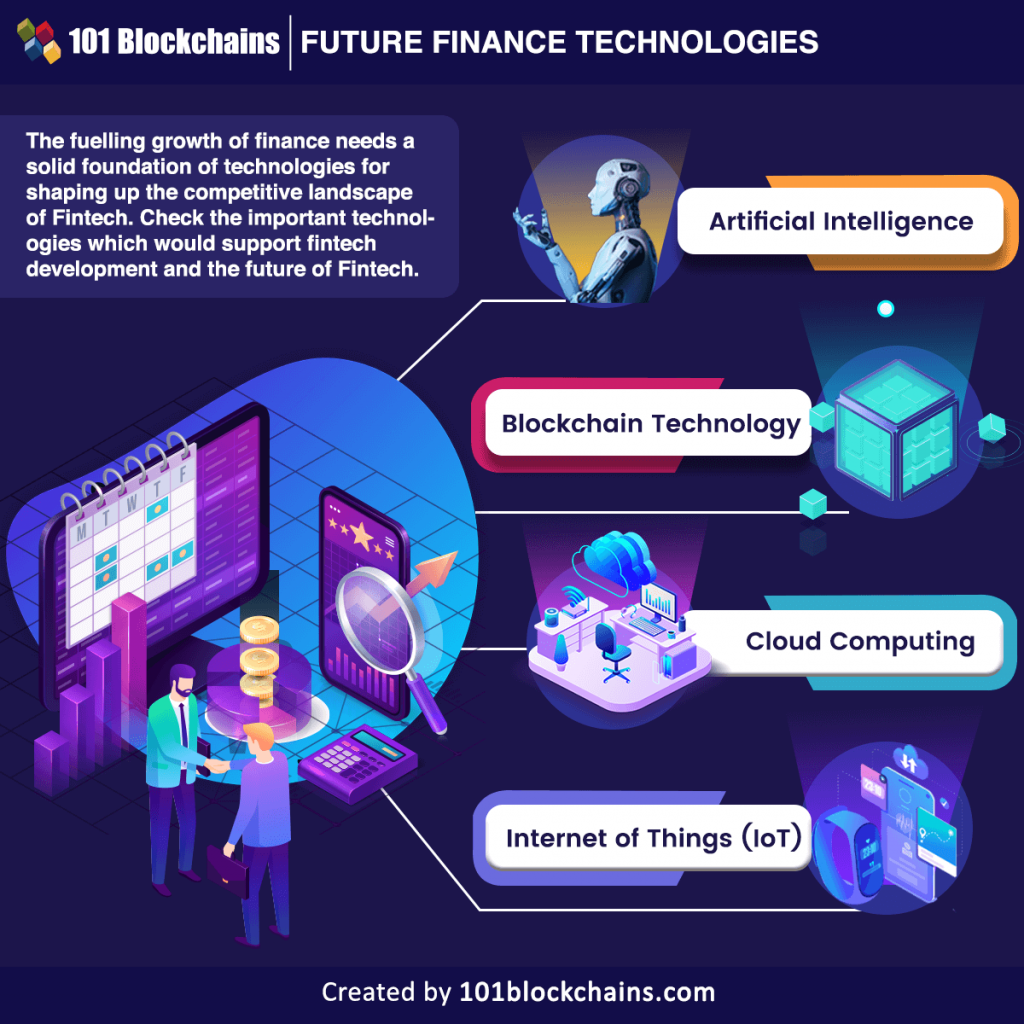

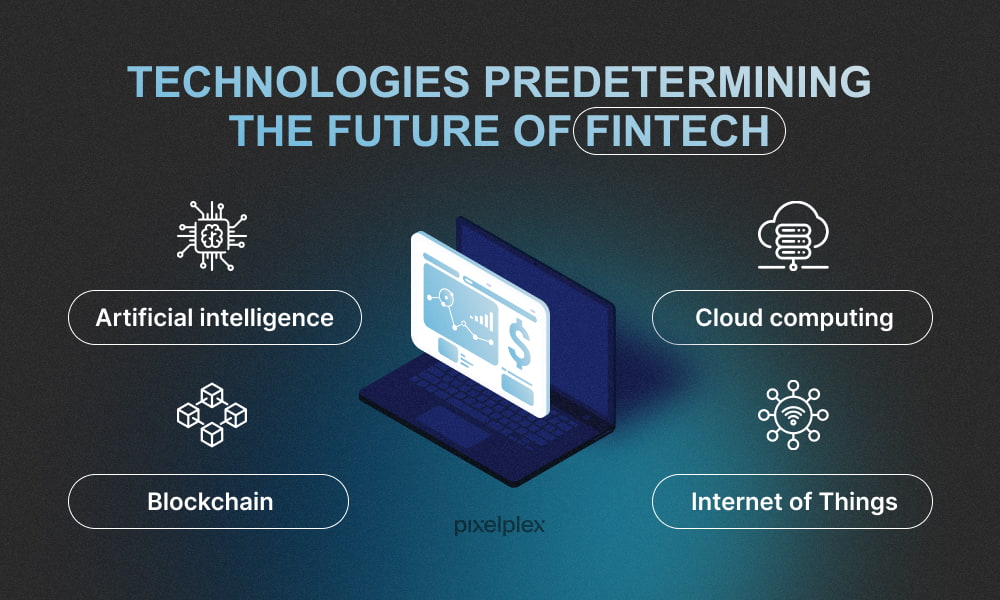

The Role of Technology in Fintech

Fintech’s explosive growth is inextricably linked to advancements in technology. These innovations aren’t merely enhancing existing financial services; they’re fundamentally reshaping the industry, creating new possibilities and disrupting traditional models. This section explores the pivotal role of several key technologies in driving this transformation.

Blockchain Technology’s Impact on Financial Services

Blockchain technology, the foundation of cryptocurrencies like Bitcoin, offers a decentralized, transparent, and secure way to record and verify transactions. Its impact on financial services is multifaceted. For example, blockchain can streamline cross-border payments by reducing reliance on intermediaries and speeding up processing times. Furthermore, it can enhance the security of financial transactions by making them virtually tamper-proof.

The potential for increased efficiency and reduced fraud makes blockchain a compelling technology for various financial applications, including supply chain finance and trade finance. Its decentralized nature also promises to democratize access to financial services, particularly for underserved populations.

Artificial Intelligence’s Transformation of Financial Operations

Artificial intelligence (AI) is rapidly transforming financial operations, automating processes and improving decision-making. AI-powered algorithms are used for fraud detection, analyzing vast datasets to identify suspicious patterns and prevent fraudulent activities more effectively than traditional methods. AI also plays a crucial role in algorithmic trading, executing trades at optimal times based on complex market analysis. Moreover, AI-driven chatbots are enhancing customer service, providing instant support and personalized advice.

The use of AI in credit scoring is also gaining traction, allowing for more accurate and inclusive assessments of creditworthiness.

Big Data Analytics in Fintech Risk Management

Big data analytics is essential for effective risk management in the fintech sector. Financial institutions leverage massive datasets to identify and assess various risks, including credit risk, market risk, and operational risk. For example, by analyzing historical transaction data, algorithms can predict the likelihood of loan defaults, enabling more informed lending decisions. Similarly, analyzing market trends and economic indicators can help mitigate market risks.

The ability to process and analyze vast amounts of data in real-time empowers fintech companies to make faster and more accurate risk assessments, leading to improved decision-making and reduced losses. A prime example is the use of big data analytics to identify and manage risks associated with online payments and fraud.

Ethical Considerations in Fintech

The rapid growth of Fintech presents significant ethical challenges that demand careful consideration. Balancing innovation with responsible practices is crucial for building trust and ensuring the long-term sustainability of the industry. This section explores key ethical dilemmas and proposes a framework for responsible Fintech innovation, also touching upon the regulatory landscape.

Ethical Dilemmas in Fintech

Fintech companies face a unique set of ethical dilemmas stemming from their reliance on data, algorithms, and access to sensitive financial information. These dilemmas often involve navigating the complexities of privacy, security, bias, and transparency.

For example, the use of AI-powered credit scoring systems raises concerns about algorithmic bias. If the data used to train these algorithms reflects existing societal biases, the resulting scores may unfairly discriminate against certain demographic groups. Similarly, the collection and use of personal financial data raise privacy concerns, especially when data is shared with third-party providers without explicit and informed consent.

Another example is the potential for financial scams and fraud facilitated by the ease and speed of online transactions. The decentralized nature of some Fintech platforms can also make it difficult to track and prevent illicit activities.

A Framework for Responsible Fintech Innovation

A robust framework for responsible Fintech innovation should incorporate several key principles. Firstly, data privacy and security must be paramount. This includes implementing strong data encryption, anonymization techniques, and robust access control measures. Secondly, algorithmic transparency and fairness should be prioritized. Companies should strive to understand and mitigate biases in their algorithms, and make their decision-making processes as transparent as possible.

Thirdly, consumer protection needs to be central. This involves clear and accessible terms of service, robust dispute resolution mechanisms, and effective measures to prevent fraud and scams. Finally, collaboration and accountability are essential. Fintech companies should work with regulators, researchers, and consumer advocacy groups to establish best practices and address emerging challenges. This collaborative approach can help foster a culture of responsible innovation.

Regulatory Challenges of Emerging Fintech Technologies

The rapid evolution of Fintech technologies, such as blockchain, AI, and decentralized finance (DeFi), presents significant regulatory challenges. Traditional regulatory frameworks often struggle to keep pace with these innovations, leading to regulatory gaps and uncertainty. For example, the decentralized and borderless nature of cryptocurrencies makes it difficult for regulators to enforce existing laws and regulations effectively. Similarly, the use of AI in financial decision-making raises questions about accountability and transparency.

Regulators are grappling with how to ensure that these technologies are used responsibly while fostering innovation. A key challenge lies in striking a balance between protecting consumers and fostering innovation. Overly restrictive regulations could stifle growth, while insufficient regulation could lead to consumer harm and market instability. Therefore, a flexible and adaptive regulatory approach is needed, one that can evolve alongside technological advancements.

Fintech Business Models and Strategies

The success of any Fintech venture hinges on a robust business model and a well-defined go-to-market strategy. This section explores various Fintech business models, contrasts their strengths and weaknesses, and Artikels the key components of a successful market entry plan, emphasizing the crucial role of customer experience.Fintech startups employ diverse business models, each tailored to specific market needs and technological capabilities.

Understanding these models is critical for aspiring entrepreneurs and investors alike. These models are not mutually exclusive; many successful Fintech companies blend elements from several approaches.

Fintech Business Model Comparisons

Successful Fintech startups utilize a variety of business models, each with unique advantages and disadvantages. For example, peer-to-peer (P2P) lending platforms, like LendingClub, operate on a transaction-fee model, earning revenue from each loan facilitated. In contrast, robo-advisors, such as Betterment, often employ an asset-under-management (AUM) fee structure, charging a percentage of the assets they manage. Payment processors, such as Stripe, typically charge a percentage of each transaction processed.

Finally, subscription-based models are increasingly common, with services offering premium features or access for a recurring fee. The choice of model depends on factors such as target market, regulatory environment, and technological capabilities. A P2P lender needs robust credit scoring algorithms, while a robo-advisor requires sophisticated investment management software.

Developing a Go-to-Market Strategy

A successful go-to-market strategy for a new Fintech product requires a multi-faceted approach. It begins with thorough market research to identify the target audience, their needs, and existing competitive offerings. This is followed by the development of a compelling value proposition that clearly articulates the product’s unique benefits and how it solves a specific problem for the customer.

A robust marketing and sales plan is essential, leveraging digital channels like social media and search engine optimization () to reach the target audience. Strategic partnerships with existing financial institutions or technology providers can significantly accelerate market penetration. Finally, a well-defined customer acquisition strategy, focusing on cost-effective channels and high conversion rates, is crucial for sustainable growth.

For instance, a new mobile payment app might partner with a popular ride-sharing service to offer incentives to new users.

The Importance of Customer Experience in Fintech

In the Fintech industry, customer experience is paramount. Trust is essential, and negative experiences can quickly erode customer confidence and brand reputation. Seamless user interfaces, intuitive navigation, and robust security measures are crucial for building trust and encouraging customer loyalty. Proactive customer support, readily available through multiple channels, is also vital. Personalization, tailored to individual customer needs and preferences, can further enhance the customer experience.

For example, a personalized financial dashboard that provides clear, concise information relevant to the user’s financial goals can significantly improve customer satisfaction. Ignoring customer experience can lead to high churn rates and damage a Fintech company’s long-term prospects. Companies that prioritize customer experience often see higher customer lifetime value and stronger brand loyalty.

Investment and Funding in Fintech

Securing funding is a crucial step for any fintech startup aiming to scale and compete in the rapidly evolving financial technology landscape. The path to securing investment can be challenging, requiring a strong business plan, a compelling pitch, and a deep understanding of the various funding options available. This section will explore the different avenues for securing capital and the key considerations investors weigh when evaluating fintech ventures.Fintech startups have access to a diverse range of funding options, each with its own set of advantages and disadvantages.

The choice of funding route often depends on the stage of the company’s development, the size of the funding needed, and the founders’ risk tolerance.

Funding Options for Fintech Startups

Fintech startups can explore several funding avenues. Venture capital firms provide significant capital investments in exchange for equity, often targeting high-growth potential companies. Angel investors, typically high-net-worth individuals, offer smaller investments, often providing valuable mentorship alongside their capital. Crowdfunding platforms allow startups to raise funds from a large number of individuals, leveraging online platforms to reach a wider audience.

Other options include bank loans, government grants, and strategic partnerships with established financial institutions. The selection of the most appropriate funding source depends heavily on the specific needs and circumstances of the individual startup. For example, a very early-stage startup might initially rely on angel investors or crowdfunding, while a more mature company might pursue venture capital or a bank loan.

Securing Funding for a Fintech Venture

The process of securing funding for a fintech venture typically involves several key steps. First, developing a comprehensive business plan is essential. This plan should clearly articulate the company’s value proposition, target market, competitive landscape, financial projections, and management team. A compelling pitch deck is also crucial, designed to concisely communicate the key aspects of the business to potential investors.

Networking with investors, attending industry events, and leveraging online platforms are all effective strategies for reaching potential investors. Finally, the due diligence process, which involves a thorough review of the company’s financials and operations, is a critical step before securing funding. A successful funding round requires meticulous preparation and a persuasive presentation to demonstrate the viability and potential of the fintech venture.

Key Investor Considerations in Fintech Investments

Investors carefully evaluate several key factors when assessing fintech investment opportunities.

- Team Expertise: Investors look for experienced and capable management teams with a proven track record in the fintech industry or related fields. A strong team increases the likelihood of successful execution.

- Market Opportunity: The size and growth potential of the target market are crucial. Investors favor companies addressing large, underserved markets with significant growth prospects. For example, the growth of mobile payments in developing economies presents a significant market opportunity.

- Technology and Innovation: The uniqueness and scalability of the technology underpinning the fintech solution are key considerations. Investors seek innovative solutions with the potential to disrupt the existing financial landscape.

- Financial Projections: Realistic and well-supported financial projections, including revenue forecasts, expense budgets, and profitability timelines, are vital. Investors need to see a clear path to profitability and significant returns on their investment.

- Regulatory Compliance: Compliance with relevant financial regulations is paramount. Investors carefully assess the company’s regulatory compliance strategy to minimize legal and operational risks.

- Competitive Landscape: A thorough analysis of the competitive landscape, including identification of key competitors and differentiation strategies, is essential. Investors want to understand how the company plans to gain and maintain a competitive edge.

- Exit Strategy: A well-defined exit strategy, outlining potential acquisition scenarios or initial public offerings (IPOs), provides investors with confidence in their ability to realize returns on their investment.

Case Studies of Successful Fintech Companies

This section examines the innovation and growth strategies of three highly successful fintech companies, analyzing the key factors that contributed to their market dominance. Understanding these success stories provides valuable insights for aspiring fintech entrepreneurs and investors. Each case study will explore the company’s unique approach, highlighting its strategic decisions and the resulting impact on its growth trajectory.

Stripe: Global Payments Infrastructure, MBA in fintech innovation

Stripe’s success stems from its focus on building a robust and developer-friendly payments infrastructure. Instead of targeting end-users directly, Stripe empowered developers to seamlessly integrate payments into their applications. This strategy allowed for rapid expansion across various industries and geographies.Stripe’s key innovation was its API-first approach. This allowed businesses of all sizes to easily integrate payment processing into their platforms, reducing friction and accelerating adoption.

Their relentless focus on developer experience and providing comprehensive documentation contributed significantly to their market leadership.

Visual Representation: Imagine a central hub (Stripe) with numerous interconnected nodes representing different businesses and applications. Arrows flow from the hub to each node, signifying the seamless integration of Stripe’s payment processing capabilities. The size of each node could represent the business’s scale, demonstrating Stripe’s broad reach across various industries and geographies. The arrows are consistently thick, representing the ease and reliability of the integration process.

The overall image communicates the scale and efficiency of Stripe’s API-driven platform.

PayPal: Evolution from Online Auction Payments to a Global Financial Services Platform

PayPal’s journey showcases a remarkable transformation from a niche payment solution for eBay to a diversified global financial services provider. Their early adoption of online payment technology, coupled with strategic acquisitions and expansion into new markets, solidified their position as a fintech giant.Key to PayPal’s success was its early mover advantage in online payments, establishing trust and brand recognition within the burgeoning e-commerce landscape.

Subsequent diversification into areas like peer-to-peer payments (Venmo), credit services, and business solutions demonstrated a strategic capacity to adapt and innovate within the evolving fintech ecosystem.

Visual Representation: A timeline graphic would effectively illustrate PayPal’s evolution. The timeline begins with a small, focused circle representing eBay payments. As the timeline progresses, the circle expands, branching out into larger circles representing Venmo, Xoom (international money transfers), and other services. The size and visual complexity of the circles directly correlate to the growth and diversification of PayPal’s offerings over time.

The overall visual represents growth from a single-focused point to a multifaceted, expansive entity.

Ant Group (Alipay): Mobile Payments and Beyond in China

Ant Group, through its Alipay platform, revolutionized mobile payments in China, establishing a near-monopoly in the domestic market. Their integration with e-commerce giant Alibaba and their expansion into various financial services demonstrate a successful model of ecosystem integration.Ant Group’s success is attributed to their deep integration with the Chinese consumer market and their leveraging of mobile technology. The platform’s ease of use, coupled with its widespread acceptance among merchants, fostered rapid adoption.

Their expansion beyond payments into areas like credit scoring, wealth management, and insurance showcases a successful strategy of building a comprehensive financial ecosystem.

Visual Representation: A large circle representing the Chinese consumer market is shown. Within this circle, a smaller, highly interconnected network of circles represents Alipay’s various financial services (payments, lending, insurance, wealth management). The lines connecting these smaller circles are thick and numerous, illustrating the strong interconnectivity and synergistic relationships within Ant Group’s ecosystem. The overall visualization highlights the dominance of Alipay within the Chinese market and the breadth of its integrated financial services.

Future Trends in Fintech Innovation

The fintech landscape is in constant flux, driven by technological advancements and evolving consumer expectations. Understanding the key trends shaping its future is crucial for anyone hoping to thrive in this dynamic industry. This section will explore five pivotal trends and their potential impact on financial services and the education needed to navigate them.

Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms and applications. Instead of directing users to separate banking apps, this model seamlessly incorporates financial tools directly within existing user workflows. For example, a ride-sharing app might offer instant financing for rides or allow users to pay with a linked digital wallet. This trend dramatically increases accessibility and convenience for consumers while offering new revenue streams for non-financial businesses.

The impact on the financial services industry is a shift from standalone institutions to integrated financial ecosystems, fostering greater competition and innovation.

Open Banking and APIs

Open banking leverages APIs (Application Programming Interfaces) to allow third-party developers access to consumer financial data with their consent. This creates opportunities for personalized financial management tools, tailored lending products, and innovative payment solutions. For instance, a budgeting app can directly access a user’s bank account data to provide real-time insights into their spending habits. The impact is a more competitive and customer-centric financial market, empowered by data-driven insights and personalized services.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are rapidly transforming financial services, automating processes, enhancing fraud detection, and personalizing customer experiences. AI-powered chatbots provide instant customer support, while ML algorithms assess creditworthiness more efficiently and accurately than traditional methods. For example, many banks now use AI to detect fraudulent transactions in real-time, preventing significant financial losses. The impact is increased efficiency, reduced costs, and improved risk management for financial institutions.

Blockchain Technology and Decentralized Finance (DeFi)

Blockchain technology underpins cryptocurrencies and DeFi applications, offering the potential for transparent, secure, and decentralized financial systems. DeFi platforms offer various financial services, such as lending, borrowing, and trading, without intermediaries. While still nascent, DeFi’s potential impact on traditional finance is significant, challenging established power structures and offering alternative financial models. For example, decentralized exchanges (DEXs) are offering users more control and lower fees compared to traditional exchanges.

RegTech and Compliance

As fintech evolves, so does the need for robust regulatory frameworks and compliance solutions. RegTech uses technology to automate and streamline compliance processes, helping financial institutions meet regulatory requirements efficiently. This includes solutions for KYC (Know Your Customer), AML (Anti-Money Laundering), and data privacy regulations. The impact is reduced compliance costs and risks, ensuring ethical and responsible fintech development.

Predictions for Fintech Education and Future Skills

The rapid evolution of fintech necessitates a continuous adaptation in education. Future fintech professionals will require a blend of technical and business acumen. Strong programming skills, data analysis capabilities, understanding of blockchain technology, knowledge of AI and ML applications in finance, and a deep understanding of regulatory frameworks will be essential. Furthermore, ethical considerations and sustainable finance practices will become increasingly important aspects of the curriculum.

Universities and training programs must adapt to equip future professionals with these critical skills to navigate the complex and ever-changing fintech landscape. For example, specialized certifications in areas like blockchain development, AI in finance, and regulatory technology are becoming increasingly sought after.

Last Point

The MBA in Fintech Innovation is more than just a degree; it’s a launchpad for a career at the forefront of financial innovation. By understanding the technology, the ethics, the business models, and the investment landscape, graduates are equipped to lead the charge in creating a more efficient, inclusive, and secure financial future. The skills gained aren’t just relevant today – they’re the key to navigating the ever-shifting terrain of tomorrow’s financial world.

This program provides a holistic view, fostering not only technical expertise but also the strategic thinking necessary to succeed in this competitive environment.

FAQ Guide

What are the job prospects after completing an MBA in Fintech Innovation?

Job prospects are excellent, with high demand for professionals skilled in both finance and technology. Expect roles in areas like financial analysis, risk management, digital banking, blockchain development, and fintech consulting.

How long does an MBA in Fintech Innovation program typically last?

Program lengths vary, but a typical full-time program lasts around 1-2 years.

Is prior experience in finance or technology required for admission?

While not always mandatory, prior experience in either field is highly advantageous and often preferred by admissions committees. A strong academic record is generally essential.

What is the average salary for graduates with an MBA in Fintech Innovation?

Salaries vary significantly based on experience, location, and specific role, but graduates often command competitive salaries well above the average for traditional MBA graduates.

Are there online or part-time MBA in Fintech Innovation programs available?

Yes, many universities now offer online or part-time options to accommodate diverse learning styles and schedules.